Rate Hike Review: A Q/A Session

by Hodges Private Client Team, on May 6, 2022

The Fed raised rates again on May 4th by 50bps (.50 percentage points). This is on the back of a 25bps hike coming out of the March meeting. In response, the market had the biggest up day of 2022. The broad indices (Dow Industrials, S&P 500, and NASDAQ) all enjoyed roughly 3% gains. Yet one day later, May 5th, was the worst down day of 2022.

Q: Why such a crazy response from the market?

A: Largely due to the whispers around this meeting. A 75bps raise and posturing for more increases of an equal magnitude was the expectation. So, a 50bps increase was viewed as a positive. As to why the market reversed a day later, I have no answer. I’ve listened to a handful of opinions in the financial news, and they do not seem to have a clear answer either. Myriad opinions with no consensus create uncertainty and markets hate uncertainty.

Q: I’m confused. Haven’t we been hearing about a really aggressive tightening cycle and that’s the reason the market went down the last month?

A: Yes we have, and the Fed language can often be confusing. It is probably best not to read too much into it. Sometimes they can plan for things several months or even a year out (as the Fed has insinuated), but there could be events that happen in the interim which could cause them to change their tone.

Q: What do you mean?

A: Well, let’s review what they have said vs. what has actually happened.

- The chatter in mid-February was that the Fed will raise rates by 50bps at the March 15th meeting, and we’ll see 6-7 more increases into mid-2023. Result: With the Russian invasion of Ukraine occurring at the end of February, they only raised rates by 25bps and ratcheted down the number of future increases to 5-6.

- Mid-April the chatter was that due to a surge in inflation, they’ll have to get really aggressive on hikes. So, at the May 4th meeting there could be a 50-75bps increase and another one of like magnitude in June. Result: 50bps increase, with a 75bps increase in the future as “something we are not actively considering.” He hinted at future 50bps hikes, but also said they’ll have to keep looking at the data.

Q: Hmmmm? Why can’t they get their story straight?

A: This is per usual with Fed prognostications. They have no crystal ball. They must look at the economic data as it comes in and then make a decision.

Q: Is there a political angle here?

A: Perhaps. I have read some articles that suggest that the Fed has become more political, and this is not a good thing. They should be totally impartial. Yet when you look at the political landscape you notice a few things. Inflation is raging, and nobody likes that word. It’s also a mid-term election year, and they tend to favor the party who lost the White House two years prior. Given the razor thin balance of power in Congress, and Biden’s current low approval rating, maybe there is some politicking going on behind the scenes. Going into midterms, what has more headline risk; high inflation or a down stock market? Probably depends on who you ask.

Q: Ugh. This is all so confusing. What do I do?

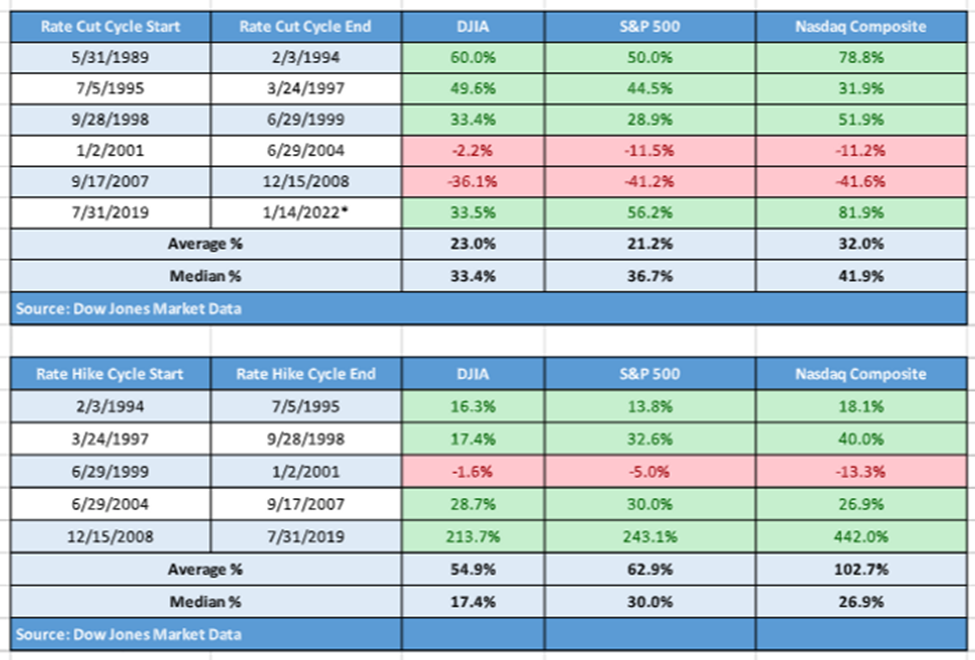

A: I think that trying to tune out the noise would be a good way to play it here. The financial markets will most likely be volatile for a while, as the press has been echoing that rate hikes are always bad for the markets. However, the attached data shows something different. There is always more at play with respect to market direction than merely interest rate changes.

Q: Interesting, how come I haven’t heard anyone talk about this?

A: Probably because the matrix contains more positive outcomes than negative, and the media doesn’t like stories about positive things. Perhaps it’s just that simple?

I do realize that the market action has not been fun to watch over the past month, and when the market is down while negative news is being dispensed, it’s hard to see the positives. In our heads, Bad news + a down market equates to confirmation that it is, indeed, bad news. It is at these junctures that using discipline and patience is the only way to get through the volatile times. Always try to remember that the only way to capture the full, long-term returns of the stock market is to endure the temporary, short-term declines.

Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.”-Peter Lynch

Hodges Private Client is a program offered through Hodges Capital Management, Inc. (“HCM”). HCM is an Investment Advisory Firm registered with the Securities and Exchange Commission (“SEC”), is a wholly owned subsidiary of Hodges Capital Holdings and serves as investment advisor to the Hodges Funds. HCM is affiliated with First Dallas Securities, Inc, a broker-dealer and investment advisor registered with the SEC.

This discussion is not intended to be a forecast of future events and should not be considered a recommendation to buy or sell any security. Past performance is not indicative of future results. Investing involves risk. Principal loss is possible. Investing in smaller companies involves additional risks such as limited liquidity and greater volatility. No current or prospective client should assume that information referenced in this communication is a recommendation to buy or sell any security or is a substitute for personalized investment advice from your individual advisor. HCM does not provide tax or legal advice. Consult your tax or legal advisor for any related questions.

All information referenced herein is from sources believed to be reliable and is provided as general market commentary and does not constitute investment advice. This material was created for informational purposes only and the opinions expressed are solely those of HCM. HCM shall not in any way be liable for claims and makes no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information. The data and information are provided as of the date referenced and are subject to change without notice.